How To Calculate Return On Equity ROE

The formula for calculating SGR is ROE times the retention ratio (or ROE times one minus the payout ratio). Instead, you can combine several financial metrics to paint a more complete picture of the company’s profitability. You can think of it as a return on investment as if you already had equity in the company.

What does ROE measure?

ROE offers a broader perspective, while ROCE is ideal for companies relying heavily on borrowed assets. If ROE is very high, then the firm has been doing exceptionally well in making profits with just a little capital invested. However, if it is low, then there might be something wrong with the decision making and the firm is not using its assets optimally. Liberated Stock Trader, founded in 2009, is committed to providing unbiased investing education through high-quality courses and books.

Free Financial Modeling Lessons

Asset turnover measures how well a company uses its assets to produce revenue; the higher the asset turnover, the more efficient it is at generating revenue from its assets, enhancing the ROE. Conversely, financial leverage, which involves using borrowed capital for investment, amplifies the potential ROE. Companies with high leverage can experience volatile ROCEs, particularly if the debt costs change or the market conditions fluctuate. Remember, while ROE can be a useful tool for comparing two companies’ profitability, it doesn’t tell the whole story. Always consider other financial metrics and qualitative factors when making investment decisions.

What are the Limitations of Return on Equity (ROE)?

Generally, a company with high return on equity (ROE) is more successful in generating cash internally. Investors are always looking for companies with high and growing returns on common equity; however, not all high ROE companies make good investments. Instead, the better benchmark is to compare a company’s return on common equity with its industry average.

Return on Equity vs. Return on Invested Capital

However, this strategy can have potential drawbacks for the company’s financial health, particularly if it takes on additional debt to fund the buyback. In this case, the amount of the preferred stock dividends for the relevant period would be subtracted from the firm’s net income (Net Income – Preferred Stock Dividends). By increasing their total equity, companies can generate more income and, therefore, increase their ROE ratio. In our modeling exercise, we’ll calculate the return on equity (ROE) for two different companies, Company A and Company B. Companies with a higher return on equity (ROE) are far more likely to be profitable from the proper allocation of capital, but also because of the ability to raise capital from outside investors if needed. Over time, if the ROE of a company is steadily increasing, that is likely a positive signal that management is creating more positive value for shareholders.

- In this case, the amount of the preferred stock dividends for the relevant period would be subtracted from the firm’s net income (Net Income – Preferred Stock Dividends).

- A higher return on common equity ratio indicates that a company is generating higher profits from the net assets that have been invested by shareholders.

- Emily Guy Birken is a former educator, lifelong money nerd, and a Plutus Award-winning freelance writer who specializes in the scientific research behind irrational money behaviors.

- A good use case is comparing a company’s ROE over time to understand whether it’s doing a better or worse job delivering profits now than in the past.

- Companies with high leverage can experience volatile ROCEs, particularly if the debt costs change or the market conditions fluctuate.

- A positive ROE signifies that a company efficiently generates profits from its equity financing.

This formula highlights the returns generated specifically on the equity held by common shareholders. Understanding this calculation is essential for investors evaluating a company’s profitability relative to shareholder equity. Return on Common Equity (ROCE) is a crucial financial metric that evaluates a company’s profitability and management efficiency.

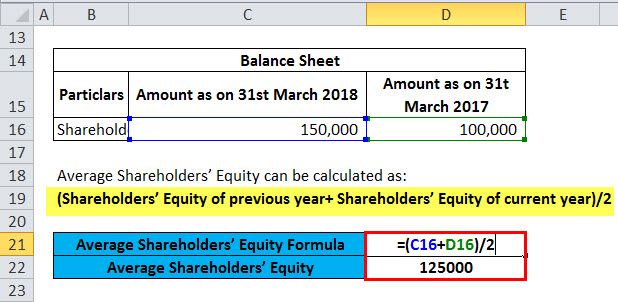

One of the most important numbers for analyzing a company is the return on common equity. In this article, we’ll start by reviewing the formula for this financial ratio and then we’ll explore how to use that number, as well as some additional financial metrics. Therefore, investors should consider the impact of industry and economic factors on ROCE while analyzing a company’s financial performance and profitability. All these financial ratios, along with ROCE, provide investors with comprehensive insights into a company’s financial performance, profitability, and valuation. The return on equity ratio formula is calculated by dividing net income by shareholder’s equity.

However, prudent investors will also take many other factors into consideration, such as earnings per share, return on invested capital, and return on total assets, before deciding to invest. The return on equity ratio varies from industry to industry and depending on a company’s strategies. For example, a retailer might expect a lower return due to the nature of its business compared to an oil and gas firm.

Net income is the profit after all expenses, taxes, and interest are deducted from total revenue, which represents the return generated for shareholders. In this case, preferred dividends are not included the 12 best free invoice templates for designers in the calculation because these profits are not available to common stockholders. A high return on equity typically signifies that a company effectively utilizes its equity base to generate profits.