Definition, Explanation and Examples

All of our content is based on objective analysis, and the opinions are our own. Changes in any one or all of these components will change the Accounting Equation. The merchandise would decrease by $5,500 and owner’s equity would also decrease by the same amount.

Balance Sheet and Income Statement

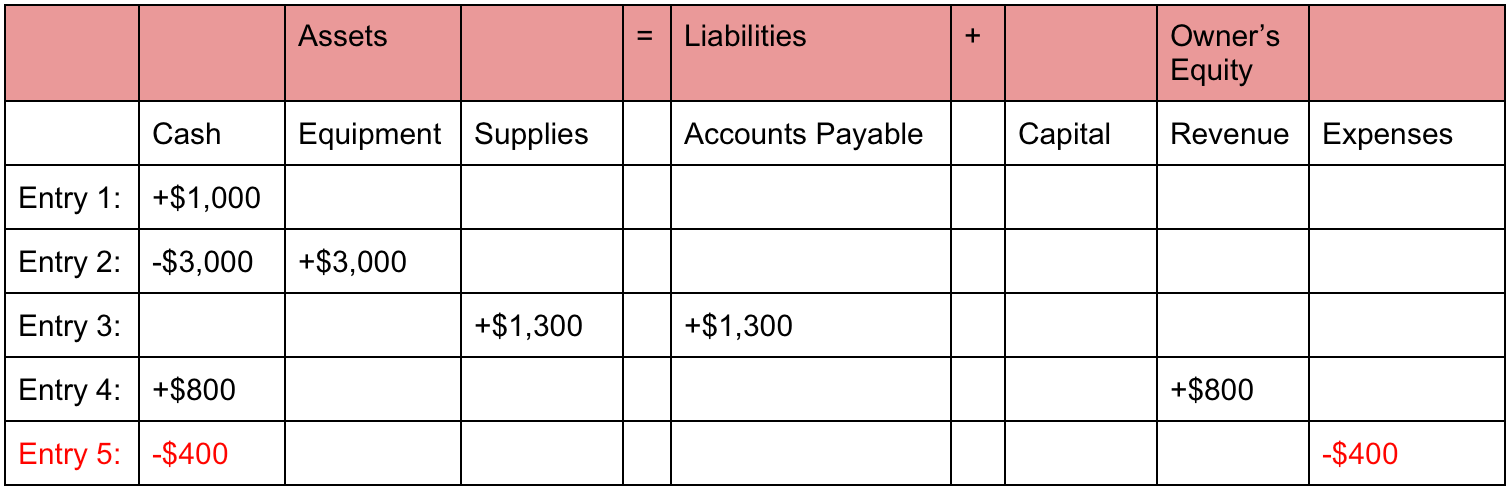

As you can see, all of these transactions always balance out the accounting equation. This equation holds true for all business activities and transactions. If assets increase, either liabilities or owner’s equity must increase to balance out the equation. The equation is generally written with liabilities appearing before owner’s equity because creditors usually have to be repaid before investors in a bankruptcy. In this sense, the liabilities are considered more current than the equity.

Accounting Equation Formula and Calculation

$10,000 of cash (asset) will be received from the bank but the business must also record an equal amount representing the fact that the loan (liability) will eventually need to be repaid. Required Explain how each of the above transactions impact the accounting equation and illustrate the cumulative effect that they have. After the company formation, Speakers, Inc. needs to buy some equipment for installing speakers, so it purchases $20,000 of installation equipment from a manufacturer for cash. In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment.

What Are the Key Components in the Accounting Equation?

Implicit to the notion of a liability is the idea of an “existing” obligation to pay or perform some duty. Liabilities and capital were not affected in transaction #3. Equity represents the portion of company assets that shareholders or partners own. In other words, the shareholders or partners own the remainder of assets once all of the liabilities are paid off. The 500 year-old accounting system where every transaction is recorded into at least two accounts.

- The difference of $500 in the cash discount would be added to the owner’s equity.

- Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- This simple formula can also be expressed in three other ways, which we’ll cover next.

- The Accounting Equation is a vital formula to understand and consider when it comes to the financial health of your business.

” The answer to this question depends on the legal form of the entity; examples of entity types include sole proprietorships, partnerships, and corporations. A sole proprietorship is a business owned by one person, and its equity would typically consist of a single owner’s capital account. Conversely, a partnership is a business owned by more than one person, with its equity consisting of a separate capital account for each partner.

Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. Understanding how the accounting equation works is one of the most important accounting skills for beginners because everything we do in accounting is somehow connected to it. The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use. Net value refers to the umbrella term that a company can keep after paying off all liabilities, also known as its book value. It specifically highlights the amount of ownership that the business owner(s) has.

As a result of this transaction, an asset (i.e., cash) increases by $10,000 while another asset ( i.e., merchandise) decreases by $9,000 (the original cost). Capital essentially represents how much the owners have invested into the business along with any accumulated retained profits or losses. The capital would ultimately belong 6 5 compare and contrast variable and absorption costing to you as the business owner. Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. Likewise, revenues increase equity while expenses decrease equity. A liability, in its simplest terms, is an amount of money owed to another person or organization.

Our PRO users get lifetime access to our accounting equation visual tutorial, cheat sheet, flashcards, quick test, and more. If a transaction is completely omitted from the accounting books, it will not unbalance the accounting equation. The accounting equation is fundamental to the double-entry bookkeeping practice.

These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses. Assets represent the valuable resources controlled by a company, while liabilities represent its obligations. Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. As we’ve learned previously, the accounting equation is a mathematical expression that shows the relationship among the different elements of accounting, i.e. assets, liabilities, and capital (or “equity”). An accounting transaction is a business activity or event that causes a measurable change in the accounting equation.

It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities. Because of the two-fold effect of business transactions, the equation always stays in balance. Metro Courier, Inc., was organized as a corporation on January 1, the company issued shares (10,000 shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son. Plus, errors are more likely to occur and be missed with single-entry accounting, whereas double-entry accounting provides checks and balances that catch clerical errors and fraud. Almost all businesses use the double-entry accounting system because, truthfully, single-entry is outdated at this point. For example, if a business signs up for accounting software, it will automatically default to double-entry.

This simple formula can also be expressed in three other ways, which we’ll cover next. At first glance, this may look overwhelming — but don’t worry because all three reveal the same information; it just depends on what kind of information you’re looking for. Analyze a company’s financial records as an analyst on a technology team in this free job simulation. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.